本回覧は、EUと英国により対ロシアへ課された主な制裁措置に焦点を当てています。

EU、第16次対ロシア制裁パッケージを採択

2025年2月24日、ロシアによるウクライナ全面侵攻から丸3年にあたるこの日に、EUは第16次対ロシア制裁パッケージを採択しました。これらの措置は、複数の規則や決定に詳述されており、こちらからご覧いただけます。また、欧州委員会は、プレスリリースおよびFAQsを発行しました。

本制裁措置は、貿易、輸送、エネルギー、インフラ、金融サービスを含む、ロシア経済の主要部門を対象としています。また、「シャドーフリート」および制裁回避を対象とした追加措置も含まれています。

最も重要な措置は以下の通りです。

制裁リストおよび制裁指定基準

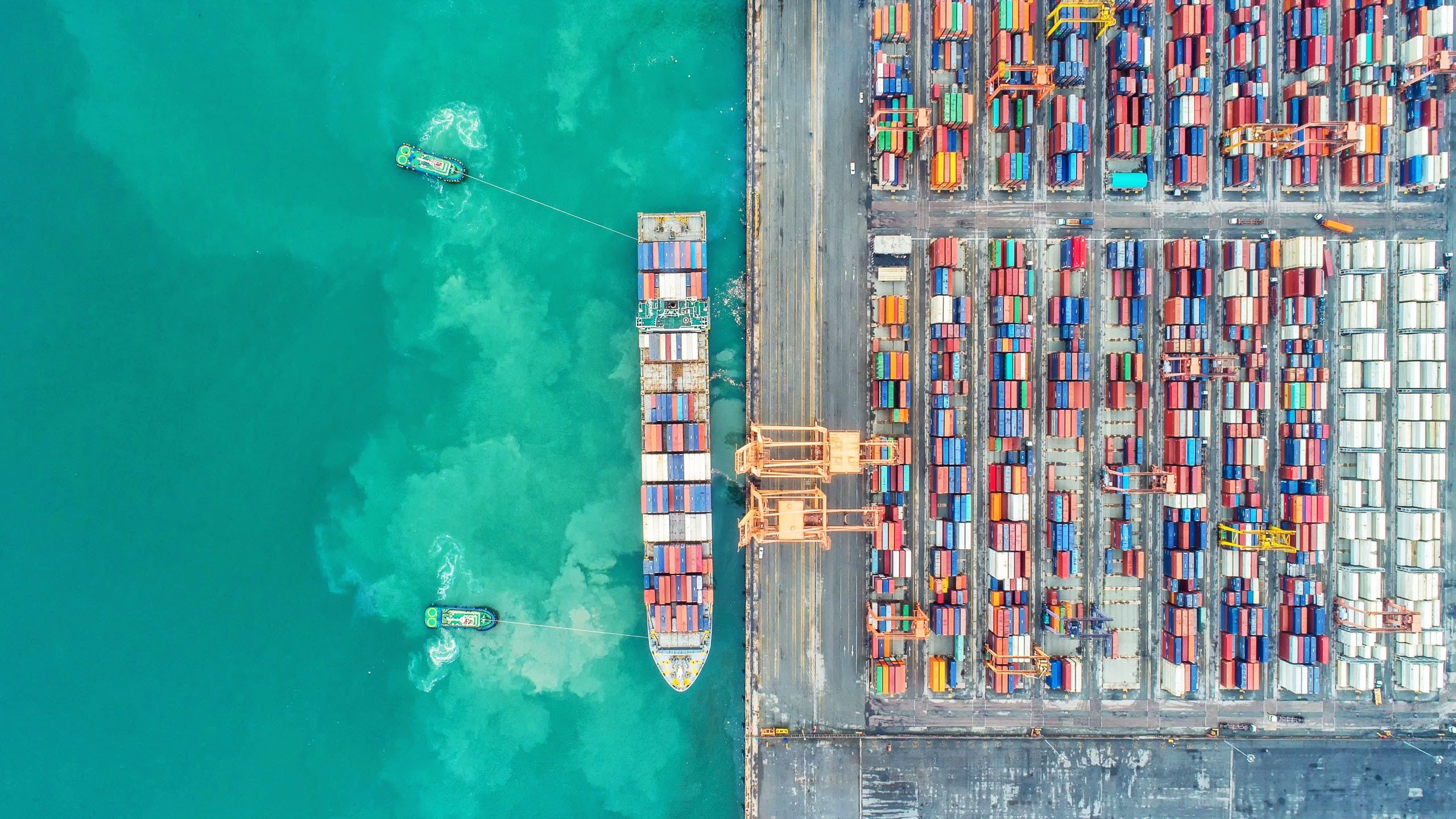

EUは、48個人と35団体をEU制裁リストに追加しました。これにより、制裁リストに追加された個人および団体は資産凍結の対象となり、資金や経済的資源の供与が禁止されます。また、ロシアの「シャドーフリート」の一部である74隻が制裁対象として指定されました。(これにより、制裁リストに掲載された船舶の総数は153隻となりました。)

制裁対象となった船舶は、ロシア産原油等に係る上限価格措置(プライスキャップ制度)の回避、ロシアのエネルギー部門の支援、ロシア向け軍事装備の輸送を行っていた非EU籍タンカーです。これらの船舶は入港禁止の対象となるほか、EUの事業者による広範な海事サービスの提供、用船、運航、乗組員の配乗、船舶間輸送やその他の貨物輸送への従事が禁止されます。また規則では、安全、海上での人命救助、人道的または環境上の目的による緊急寄港を含む、上記入港禁止措置に対する除外リストを更新しました。

EUはまた、個人と団体をEU制裁リストへ指定するため、2つの新しい基準を導入しました:(1)ロシアの「シャドーフリート」の船舶を所有、支配、管理、または運航する者、および(2)ロシアの軍産複合体を支援する者またはそこから利益を得ている者

取引禁止

EU理事会規則2025/395(EU理事会規則833/2014をさらに改正するもの)の新条項である第5ae条附属書XLVIIのPart Aに列挙されているロシアの港および閘門と直接的または間接的に取引を行うことは禁止されます。Part AにはUst-Luga港、Primorsk港、Novorossiysk港が含まれており、これは、「不規則で高リスクの輸送行為」に関与する船舶により、ロシア産原油や石油製品の海上輸送にこれらの港が使用されているためです。

また、ヴォルガ川沿いに位置するAstrakhan港やカスピ海に面するMakhachkala港も、ロシアの対ウクライナ戦争を支援するための無人航空機やミサイル、関連技術の輸送に使用されているため、Part Aに含まれています。

取引禁止には、さまざまな例外があります(第5条ae(3)に規定):

(a) 船舶が避難場所を求め支援を必要としている場合、海上安全のため、人命救助のため、人道的目的のため、人間の健康および安全、または環境に深刻かつ重大な影響を及ぼす可能性のある事象の緊急的な予防または軽減のために緊急寄港が必要な場合、または自然災害への対応を必要とする場合;

(b)ロシアから、またはロシアを経由して、天然ガス、チタン、アルミニウム、銅、ニッケル、パラジウム、鉄鉱石をEU、欧州経済領域加盟国、スイス、西バルカン諸国へ直接的または間接的に購入、輸入、または輸送するために必要不可欠な取引;

(c)第3m条または第3n条で禁止されていない限り、ロシアから、またはロシアを経由して、石油精製品を含む石油を直接的または間接的に購入、輸入、または輸送するために必要不可欠な取引;

(d)本規則に基づき輸入、購入、輸送が許可されている医薬品、医療品、農産物および食料品(小麦および肥料を含む)の購入、輸入、または輸送に必要な取引;

(e)附属書XXVに記載されている海上輸送による原油および石油製品の購入、輸入、または輸送に関する取引で、当該品の原産地が第三国であり、かつロシアで船積みされるか、ロシアを発航するか、またはロシアを通過するのみであるもの。ただし、当該品の原産地がロシアでなく、所有者がロシア人でない場合に限る。

(f)民生用核能力の確立、運転、保守、燃料供給、再処理および安全、ならびに民生用核施設の完成に要する設計、建設および試運転の継続に必要な取引。

上記(c)の除外条項は、プライスキャップ制度に準拠した原油または石油製品の輸送を含むものと思われます。

石炭輸送には除外条項はありません。国際P&Iグループは、これは意図的な省略なのか、また、さらなるFAQを発表する意図があるかについて、欧州委員会へ説明を求めています。

EUの事業者は、法人が設立されている、またはその法律に基づき設立されているEU加盟国の管轄当局へ、上記規則に基づくいかなる取引および関連する除外について、2週間以内に通知する義務があります。(EU理事会規則833/2014を改正するEU理事会規則2025/395の第5ae条5項) 当該加盟国は、本情報受領後2週間以内に、他のEU加盟国および欧州委員会に報告する必要があります。

貿易制限

ロシアからEUへのアルミニウム加工製品の輸入はすでに禁止されています。ロシアに大きな収益をもたらすことから、本パッケージにはロシア産のアルミニウムの塊(CNコード7601)のEUへの輸入または輸送の禁止と、関連保険の提供の禁止が含まれます(EU理事会規則833/2014をさらに改正するEU理事会規則2025/395の第3i条(第3cg条)-(第3ch条))。本制限は、割り当て制を使用して段階的に導入されます。段階的導入期間中、2026年2月26日に禁止が完全に発効するまでの向こう12ヶ月間、最大275,000トンまでロシアからのアルミニウムの塊の輸入が許可されます。2025年2月25日以前に締結されたアルミニウムの塊の契約(または当該契約の履行に必要な付随契約)については、2026年2月26日から2026年12月31日までの期間、最大50,000トンまでEUへの輸入が許可されます。メンバーの皆様は、ロシアから第三国へアルミニウムを輸送することは英国制裁の下で禁止されている(ロシア(制裁)(EU離脱)規則2019の規則46IIおよび別表3BA)ことにご注意ください。従って、クラブによりそのような運送および取引のための保険提供が許可されているか確認することを強くお勧めします。

本制裁パッケージは、ロシアによる主要技術へのアクセスを制限するため、民間・軍事の両用が可能なデュアルユース品の輸出制限を拡大しました。

新たな品目は次の通りです:(a)ロシアが化学兵器として使用するクロルピクリン、その他暴徒鎮圧剤を製造するための化学物質前駆体、(b)兵器製造に使用されるコンピュータ数値制御(CNC)工作機械用のソフトウェアおよび、ロシアが戦場でドローンを操作するために使用しているビデオゲームコントローラー、(c)軍事用途に用いられるクロム鉱石および化合物。

また、ロシアの軍産複合体を直接支援している、あるいは制裁回避に関与している53団体に対し、輸出制限を課しています。デュアルユース品や技術の輸出規制強化の対象となるこれらの団体は、ロシアだけでなく、中国(および香港)、インド、カザフスタン、シンガポール、トルコ、アラブ首長国連邦、ウズベキスタンを含む第三国にも拠点を置いています。

エネルギー

EU港では、プライスキャップに準拠した貨物の一時保管が全面的に禁止されました。

すでに実施されている、ロシアの液化天然ガス(LNG)プロジェクト完成のための物品、技術、サービスの提供の禁止は、Vostok Oilプロジェクトなど、ロシアの原油プロジェクトにも拡大されました。さらに、石油・ガス探査に関連するソフトウェアのロシアへの輸出を制限するため、既存のソフトウェア禁止措置が拡大されました。

輸送

EUの飛行禁止措置は、ロシア国内で国内線を運航する、またはロシアの航空会社に航空用品を供給する第三国の航空会社にも拡大されました。制裁リストに掲載された航空会社は、EU領空への飛行が禁止されます。

銀行取引

13のロシアの銀行が新たにSWIFTシステムより排除されました(金融専門のメッセージングサービスの利用等の禁止)。新たな制裁パッケージにより、EUは、プライスキャップの回避に関与した金融機関および、「シャドーフリート」に関連する船舶との取引を促進する金融機関を制裁リストに追加することが可能となりました。

ベラルーシとウクライナの非政府支配地域

本制裁パッケージには、ロシアに対する新たな貿易関連制裁と同等の、ベラルーシに対する更なる制限措置が含まれています。また、EU制裁の回避を防ぐため、クリミアとセヴァストポリ、およびウクライナの非政府支配地域(ドネツク、ヘルソン、ルハンスク、ザポリージャ)に関する新たな制限も導入しています。

英国が2022年以来最大規模の対ロシア制裁パッケージを発表

ウクライナ侵攻から丸3年にあたる2025年2月24日、英国は新たに100以上の制裁措置を課しました:

- 中央アジア諸国、トルコ、タイ、インド、中国を含むさまざまな第三国に拠点を置く、ロシア軍向けの工作機械、電子機器、デュアルユース品、兵器システムに使用されるマイクロプロセッサーを含む、ロシア軍向け製品の製造業者およびサプライヤー

- 北朝鮮国防相、ロシアへの北朝鮮軍の派遣に加担したその他北朝鮮の将軍と高官

- 違法な戦争を支援するため、LLC Grant-Tradeを利用してヨーロッパの先進技術をロシアに流した企業とその所有者を含む13のロシアの個人・団体

- ロシア産の石油を輸送する40隻の「シャドーフリート」(これにより、英国により制裁対象とされた石油タンカーの総数は133隻となりました。)

ロシアが関与する取引は、非常に重要な法的規制の対象となります。メンバーの皆様は、適用される制裁措置に違反するいかなる取引に対しても保険カバーが適用されないことにご留意ください。また、制裁リスクの高い取引に従事する前に、関与または関与の可能性のある関係者、貨物、船舶およびその他のサービス提供者に関し、取引全体を通じて徹底的なデューデリジェンスを実施することをお勧めいたします。さらに、デューデリジェンスの調査結果を記録に残すことを推奨いたします。

国際グループのすべてのクラブは同様の回覧を発行しています。

UKP&Iクラブ 日本支店 訳