UKクラブ2021年2月期の決算概要が発表されました。日本語版は下記よりダウンロードしていただけます。

Financial strength maintained despite exceptional circumstances

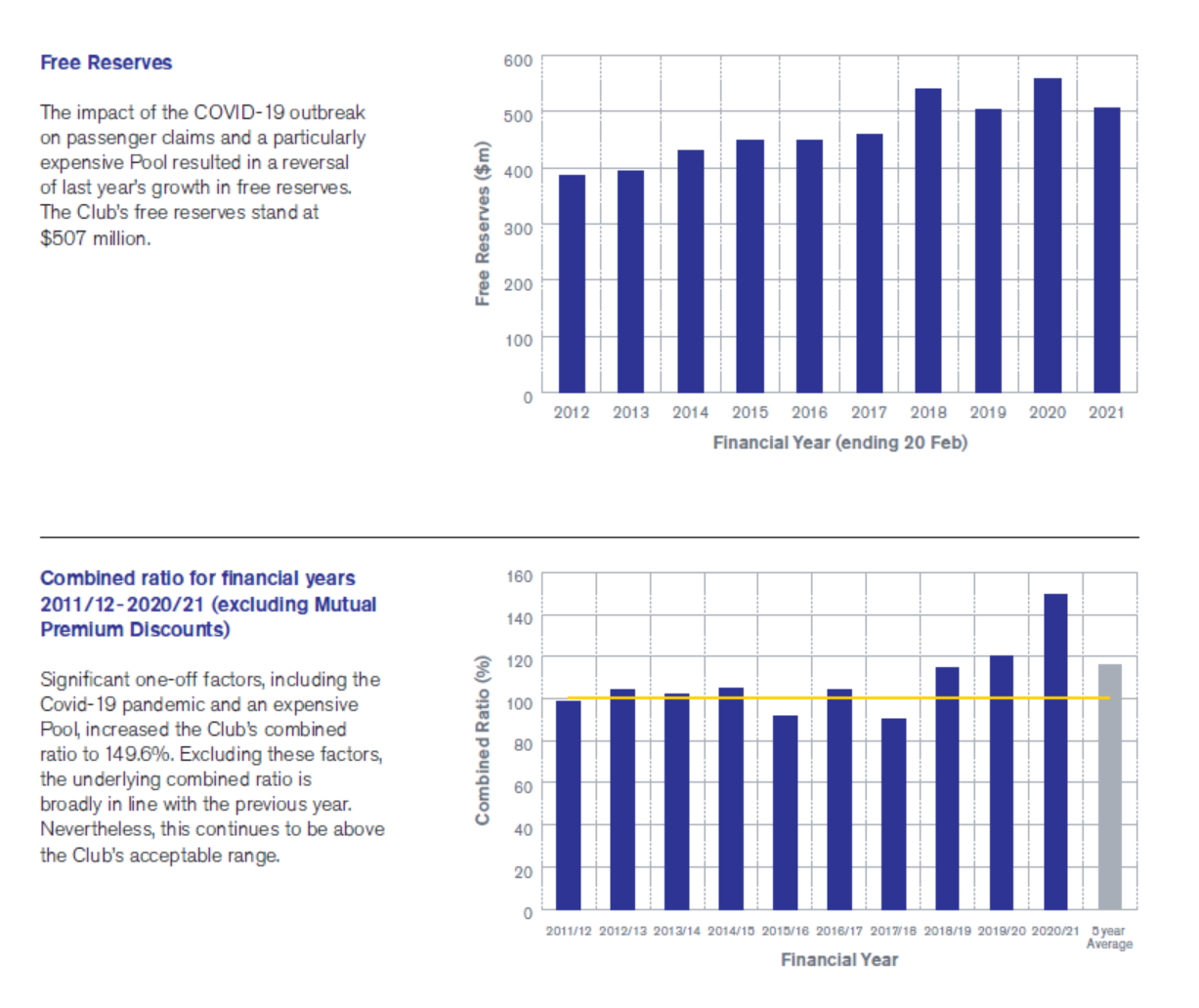

The Club’s financial position remains strong with free reserves of $507 million as at 20 February 2021. The Club continues to comfortably meet all its regulatory capital requirements. Standard & Poor’s reaffirmed the Club’s A rating in December 2020.

In an unprecedented year, the Club’s underwriting result was impacted by some significant one-off factors. Claims arising as a result of the Covid-19 pandemic and an exceptionally expensive year for claims shared through the International Group Pool increased the Club’s combined ratio to 149.6%. Excluding these factors, the underlying combined ratio was broadly in line with the previous year. Nevertheless, this continues to be above the Club’s acceptable range.

It was a volatile year for investments. However, over the twelve month period the Club made a strong return of 5.6% ($59 million before expenses) which supported the Club’s overall financial result.

Chairman's Statement

In my last report, I noted that the Club had successfully responded to the onset of COVID-19. At that time, few could have anticipated the full extent of the pandemic on every individual, family and business across the world. Last year was particularly testing for several shipping sectors with global restrictions or poor market conditions severely limiting potential trade.

However, overall, the industry showed considerable resilience in a challenging environment. We can be proud of the efforts of our people and particularly our crew members, many of whom were unable to leave or join ships for extended periods as travel limitations were imposed.

I am also proud of the Club’s robust response as the world shut down. Members have continued to experience the same high-quality, professional service that has characterised the UK Club for many years.

One of the immediate impacts of the pandemic was an unprecedented reduction in asset values across the world’s major financial markets. However, markets rallied strongly as the year progressed and the Club is able to report a very creditable investment return for the year of nearly $60 million. I am grateful for the oversight provided by the Club’s Investment Committee, which continued to meet virtually as the year unfolded.

The investment return offsets a deficit in the Club’s underwriting result for the year. I noted in my report last year that premium rates across the market were no longer sufficient to cover the associated claims and expenses and that, as a result, rates would have to increase. We took the first step to correct the ratings deficit at the last renewal by imposing a 10% General Increase. This delivered a significant improvement in the overall rating but further increases will be required in order to resolve the underwriting deficit.

Members have continued to experience the same high-quality, professional service that has characterised the UK Club for many years

The underlying inadequacy in premium rates was exacerbated last year by the impact of the pandemic. Claims directly arising from the Covid-19 outbreak amounted to over $25 million during the year. This, combined with a short term reduction in premium as some sectors suspended trading, had a material one-off impact on the Club’s underwriting result.

During the first half of the year, the International Group pool, through which the largest P&I claims in the market are shared between Clubs, was unusually active. The average cost of large claims has increased in recent years, which has amplified their significance on the Club’s overall result. Although the frequency of these claims eased in the second half of the year, the overall cost is still one of the largest in history.

The exceptional features of the 2020/21 financial year, arising from the pandemic and the expensive pool, have increased the Club’s combined ratio to 149.6%. This is a one off result, with the combined ratio expected to improve significantly next year, but illustrates the importance of the Club’s strong capital base. At over $500 million, the Club’s free reserves are among the strongest in the industry and comfortably meet the highest AAA band of the S&P capital model.

The strength of the capital position combined with a best in class service capability are the cornerstones of the Club’s overall proposition. Member confidence and support for the UK Club remains extremely strong, as evidenced at the last renewal. In what remains a competitive market, 98% of all Members renewed showing the strength of the Club’s long-term partnerships with Members.

Close partnerships are vital in the event of a major incident. As I write, the Ever Given grounding in the Suez Canal is very much a live issue. Fortunately, nobody was injured in the incident but the importance of global shipping in the modern world was certainly put into sharp relief. The Club insures the owners of the Ever Given for certain third-party liabilities, and I want to thank the team working tirelessly to ensure the highest quality response and support.

My role as Chairman is only possible with the support and contribution of the many people involved in the Club. I would like to take this opportunity to extend my thanks to my Deputy Chairmen, Mr. R. Chen of Wan Hai Lines, Mr N. Schües of Reederei F. Laeisz and Mr P. Wogan of GasLog. Their support on all Club matters has been invaluable during the challenges of the past year.

The Members’ Committee continued to meet in a virtual format during the year. I am pleased to welcome: Mr D. Grzebinski of Kirby Corporation, Houston, Ms S. Paliou of Diana Shipping SA, Athens, Mr M. Pavić of Tankerska Plovidba dd, Zadar, Mr Tao Weidong of China COSCO Shipping Corporation Limited, Shanghai and Mr J. Toledo de Souza of Petrobras Transporte S/A – Transpetro, Rio de Janeiro. I would like to thank Messrs Ali Shehab of Kuwait Oil Tanker Co SAK, Kuwait, E. Ambrosov of OAO Sovcomflot and Sun Jiakang of China Ocean Shipping (Group) Co and P. Wogan of GasLog who have retired from the Members’ Committee over the past year. The Members’ Committee is vital to our work as a Mutual and to our commitment to work in partnership with Members.

As I look ahead and consider the future, there are significant challenges ahead for our industry. Solutions will need to be found and implemented for the decarbonisation of fuel and further improvements are needed to improve the safety of our ships. The experience of this last year shows that, as an industry, we can rise to meet new challenges and emerge firm footed on our future path. As a Club, our goal is to grow strong partnerships and support our Members through close co-operation and an ethos for excellent service. The Club’s ambition and commitment is to be a partner for our Members – a partner in all business needs; from safety and loss prevention to advice on contracts and technical issues. Most importantly of all we are there for our members when things go wrong.

In the coming year, we are committed to improving the Club, listening to what our Members and their brokers want, and understanding how we can partner and support your company. As the vaccination initiatives gather pace around the world, I am optimistic that we will soon be able to resume many aspects of our personal and business lives that have been on hold over the last year, including the face to face meetings that are vital to Club relationships.

Finally, I would like to thank our Managers and all those working around the world for the work they do for our Members. Their ability and willingness to provide assistance to Members, especially in times of crisis, remains one of the most important and valuable features of our Club.

Nicholas Inglessis

Chairman