THIS release provides the International Group’s renewal rates for 2022/23 policy year. Members can read the original article on the International Group website.

Given the hardening market conditions and the well-publicised deterioration in the Group’s claims record with its reinsurance partners (which has been the main driver in the increase in rates), the Group has agreed to pay an increase in premiums to the markets to renew its 2022 reinsurance programme.

The Group’s renewal followed a two year contract on its main General Excess of Loss (“GXL”) placement (US$2bn excess of US$100m). It was also renewing its Collective Overspill programme (US$1 bn excess of US$2.1bn) and one of the three 10% multi-year private placements that provide cover in the layer US$650m xs US$100m.

Nevertheless, in challenging market conditions and despite initial market concerns that malicious cyber, Covid-19 and future pandemics represented systemic risks, the Group has worked collectively with its longstanding reinsurance partners to secure the contract that continues to allow Group Clubs to offer uniquely high levels of free and unlimited coverage for all risks.

In order to achieve this, there have been some adjustments to the main GXL placement which are explained in detail below.

As part of its annual analysis to ensure the fairness of cost allocation between different vessel types, the Reinsurance Committee has also considered its current vessel categories. Having given due consideration, prices for different vessel categories have been adjusted accordingly as set out in detail at the end of this message.

Statement from the Chairman of the International Group’s Reinsurance Committee – Mike Hall,

“The Group’s decision to renew the majority of its programme for two years in 2020 provided our Members with the benefits of price stability and continuity of cover for those two years. However, during the intervening period a combination of hardening market conditions, a global pandemic, a number of coverage issues, plus a worsening claims record, have all resulted in the 2022 renewal being particularly challenging to negotiate. That said, our longstanding reinsurance partners have understood the unique nature of the Group’s coverage requirements, in support of the global shipping community, and we are grateful to them and the Group’s brokers for their continued support in finalising this year’s reinsurance programme.”

Renewal Overview

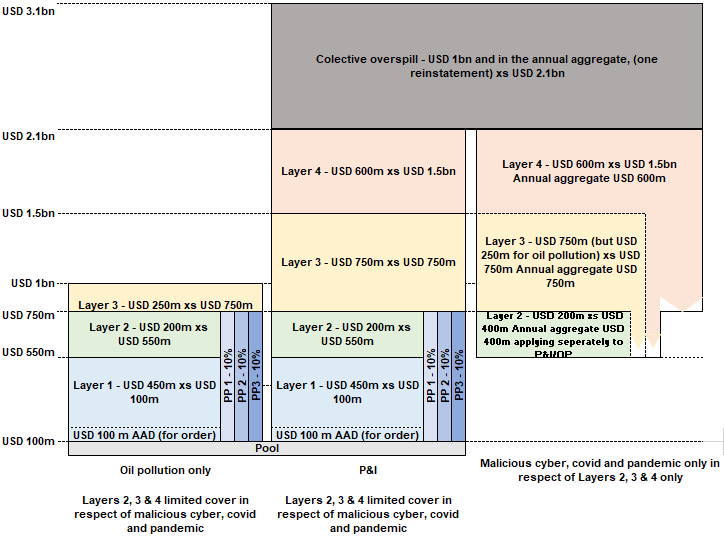

The main GXL placement (layers 1-3, US$2 billion excess of US$100m) has now been split into four layers, with the Collective Overspill renewed excess of the GXL, and the three private placements also maintained in place. As such, the entire commercial market placement can be summarised as follows:

- Private Placements: 30% of the Layer US$650m excess of US$100m has been secured on expiring coverage terms. This percentage is covered by three private market placements which are renewed independently of the main GXL programme;

- Main General Excess of Loss: These placements have been renewed with unamended, free and unlimited, coverage forall risks except:

- Malicious Cyber

- COVID

- Pandemic

- Other placements: The Collective Overspill (US$1bn excess of US$2.1 bn) and ancillary covers are being been renewed with premiums included within the overall rate per GT.

The Group’s Bermudan based reinsurance captive Hydra continues to support the Group through its risk retention within the lower Layers of the Group’s reinsurance structure. The Group’s strategy of placing a share of the reinsurance programme on a stand-alone basis through the use of private placements has also continued to give shipowners greater stability in a year when market sentiment has been volatile as a result of the impact of the COVID-19 pandemic, increased severity of pool claims and market coverage issues.

The difficult prevailing market conditions and the need to maintain the broadest cover available have led to significant rate rises for 2022. In this regard whilst rates for shipowners have increased by an average of 33% year-on-year, the new rates are similar to those rates per gt in 2014/15.

Individual Club retention and GXL programme attachment

Individual Club retention remains unchanged for the 2022/23 policy year at US$10 million, as does the structure of the Pool and the attachment point for the GXL programme.

Reinsurance structure 2022

One of the three current Private Placements (together totalling 30% of US$650m excess US$100m) was due for renewal for the 2022 policy year. Renewal of this layer was secured early in the process on the basis of no change to coverage, and with the incumbent market. The remaining two private placements each have at least one more year to run.

With regard to the 70% balance of the expiring Layer 1 and the expiring Layers 2 and 3 of the previous structure a change was negotiated with the reinsurance markets, as follows:

- The expiring Layer 1 (US$650m excess of US$100m) has been split into a new Layer 1 (US$450m excess of US$100m) and a new Layer 2 (US$200m excess of US$550m).

- The US$100m AAD (retained by the Group’s captive Hydra), within the 70% market share of Layer 1 of the programme remains in place.

- Excess of the new Layer 2, the layers remain as US$750m excess of US$750m (Layer 3), and US$ 600m excess of US$ 1.5bn (Layer 4). Both these Layers are placed 100% in the market.

There was no change to the Collective Overspill layer, which provides US$1bn of cover excess of US$2.1bn.

As noted within the Overview above, in the two years since the inception of the expiring GXL programme, reinsurers have introduced market-wide coverage restrictions in respect of Malicious Cyber, Covid-19 and other new Pandemics. Within the GXL for 2022, the Group have secured a significant level of cover, as follows:

- The new Layer 1 has been put in place with no amendment to coverage for the 2022 year, resulting in free and unlimited reinsurance for all losses including those arising from Malicious Cyber, Covid-19 and Pandemic losses up to US$ 550m per vessel.

- Within Layers 2, 3 and 4, free and unlimited cover for all losses, but for those arising from Malicious Cyber, Covid-19 and Pandemics where each layer has an annual aggregate limit in place, totalling US$2.15bn in annual aggregate cover for these risks across these three layers.

- As set out in the Overview, Group Clubs have agreed to Pool any losses that exceed the annual aggregate limit recoverable from the GXL, resulting in no change to Member cover.

Hydra participation

Hydra continues to provide cover within the pooled layers of the programme and a US$100 million AAD in the 70% market share of layer 1 of the GXL programme

MLC cover

The MLC market reinsurance cover is being renewed for 2022 at competitive market terms, with the premium included in the overall reinsurance rates charged to shipowners.

War cover

The excess War P&I cover will be renewed for 2022 for a period of 12 months. Again, this will be included in the total rates charged to shipowners.

2022 GXL programme structure

The diagram below illustrates the layer and participation structure of the GXL programme for 2022.

Reinsurance cost allocation 2022

As part of its annual analysis and in addition to reviewing premiums, the Reinsurance Committee (RIC) has, as referred to above, been looking at vessel categories.

The conclusions of the RIC are that there should be no change in the number of categories but that there should be some adjustments to the relative rate changes having regard to historical claims performance.

The 2022 rates are set out below:

Tonnage category 2022 rate in US cents per gt % change in rate per GT

| Persistent Oil tankers | 64.69 | +15.0% |

| Clean Tankers | 36.66 | +40.0% |

| Dry | 56.39 | +40.0% |

| FCC | 65.86 | +55.0% |

| Passenger | 386.77 | +18.6% |

| Chartered tankers | 29.09 | +33% |

| Chartered dries | 14.20 | +33% |

This is a satisfactory reinsurance renewal for the International Group and its Members, given the difficult prevailing market conditions.”

Mike Hall – Chairman of the International Group Reinsurance Subcommittee

DATE 21 December 2021